Message from the General Manager of the Business Development Department

Main new business initiatives to realize our Medium-Term Vision

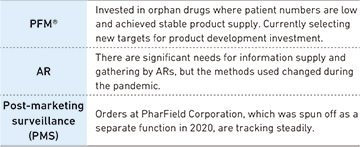

Overview of FY2023

We are targeting ordinary profit of ¥100 billion in the fiscal year ending March 31, 2027, the final year of our 2027 MEDIPAL Medium-Term Vision. This includes a target of ¥20 billion for new businesses. We are actively progressing various initiatives to achieve this. In the fiscal year ended March 31, 2023, new businesses generated ordinary profit of ¥9.2 billion, roughly on track versus the target of ¥9.4 billion.

Thus far, we have focused on new businesses as a key strategy unique to the MEDIPAL Group, and we have succeeded in growing them into businesses capable of sustained profit creation. However, we recognize that we are now approaching a period of change as we move into the next growth stage. We will need to do more than just expand existing businesses like AR and PFM® if we are to achieve further growth in the future. We also need to realize and evolve the strategies set out in the Medium-Term Vision, including expansion of overseas business and enhancement of business with and in digital.

By going beyond our conventional business frameworks thus far, we will broaden our outlook and be in a position to develop businesses that generate new profits.

Digital health

We are pursuing healthcare DX by combining the business resources of the MEDIPAL Group with the resources at our partners. We are focused on efficient business development by leveraging our customer base and collaborating with partners that bring advanced technologies and expertise to the table.

We started a capital alliance with MTI Ltd. in 2016 and this collaboration has helped MTI Ltd. to introduce its electronic maternal and child health handbook “Boshi-mo” to over 520 municipalities (as of March 31, 2023) and expand its services to support the digital transformation of childcare services. MTI Ltd. is digitalizing processes in childcare support services, such as screening questionnaires before childhood vaccinations and infant health checks or government funding claims. MEDIPAL invested in LAYERED Inc. in January 2023 via the CVC fund. Layered Inc. develops systems to ensure efficient clinic operations, more opportunities for communication with patients, and better support for healthcare DX at family doctors, thus improving operational efficiency and convenience at clinics.

It may take time to generate earnings in the digital health field, but we think this area has the potential to become new infrastructure in the future, so we need to take a long-term perspective. At the same time, it is vital that we work out how to monetize our business in the face of increasing competition. At the moment we are progressing a number of initiatives in isolation, but in the future I think we need to connect these programs organically to develop infrastructure, which in turn may point the way to monetization in this field.

Collaboration with JCR Pharmaceuticals Co., Ltd. and future strategy overseas

MEDIPAL HOLDINGS is collaborating with JCR Pharmaceuticals Co., Ltd. on the global development of new drugs in the ultra-rare disease area. We have signed an agreement on the global commercialization of treatments for four ultra-rare diseases that use JCR’s J-Brain Cargo blood-brain barrier (BBB) penetration technology. One of the properties of the brain is the ability to take up iron. The J-Brain Cargo technology uses this property to pass through the BBB and deliver drugs within the brain. J-Brain Cargo is also capable of effectively delivering drugs within the skeletal muscles, where drug delivery has proven difficult thus far.

MEDIPAL HOLDINGS plans to obtain a license to market overseas our own pharmaceuticals that use the J-Brain Cargo technology, and develop our business globally through development and distribution. We are already making preparations and are working to develop the necessary systems over the next two or three years. This represents a step forward from the typical PFM® initiatives we have engaged with thus far, and will be a challenging program for our company. Through this initiative, we will work with JCR Pharmaceuticals Co., Ltd. to deliver new treatments as soon as possible to patients and their families around the world.

Corporate venture capital (CVC)

The CVC fund has now made ten investments, including Grace imaging, Inc. announced in July 2023. We are investigating possible investments in different venture companies using the diverse sourcing functions of SBI Investment Co., Ltd, a wholly owned subsidiary of SBI Holdings, Inc. We aim to contribute profits to the Group’s core businesses by marketing and distributing innovative products created through the investments.

We are now making more investments and also improving our evaluation processes. We will work faster to create breakthrough services only found at the MEDIPAL Group.

Human resources development to achieve our Medium-Term Vision

Recruitment and training of human resources is a key issue when developing new businesses. To rapidly progress our growth strategy, we need to bring in human resources with experience and a good track record. We are working on midcareer recruitment of people who have experience at pharmaceutical companies overseas, and are involved in the development of human resources at our company. We are also training up employees responsible for overseas business development by transferring them to partner companies like JCR Pharmaceuticals Co., Ltd.

Our Rare Disease MRs (RD-MRs*) have a wealth of experience as specialists in rare diseases and specialize in providing information on orphan drugs. We look to strengthen our training systems in the future so that ARs can take on new roles in the fields of digital health or PMS.