Corporate Governance

Basic Policy

The MEDIPAL Group places importance on maximizing corporate value, while ensuring transparency and soundness of management. The Group also believes that disclosing high-quality information is one of its responsibilities to stakeholders, and that it enhances the transparency and soundness of management. Therefore, the Group takes a proactive approach to appropriate and timely disclosure.

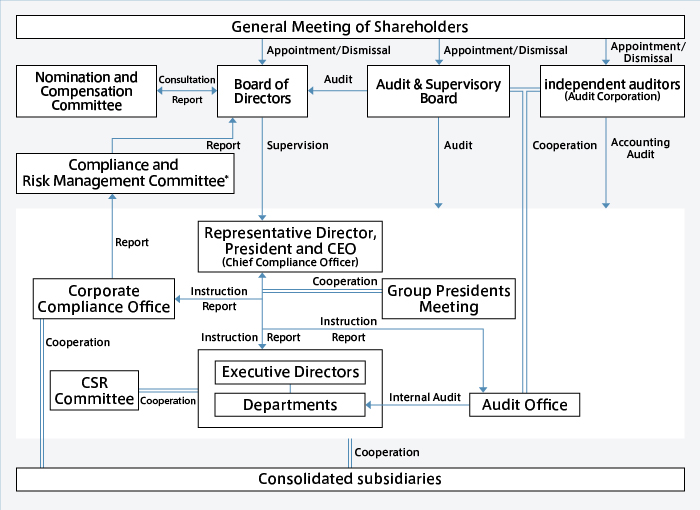

Corporate Governance Structure

* On April 1, 2025, the Compliance Committee was renamed the Compliance and Risk Management Committee.

Role and Composition of Board of Directors

The Board of Directors considers and decides matters stipulated by management policy and by laws, as well as other important matters concerning corporate management, and also supervises the status of overall business execution. The Board holds monthly meetings and, when necessary, extraordinary meetings. Audit & Supervisory Board members attend these meetings. Representative directors of main consolidated subsidiaries are appointed as directors of the Company to share information.

The Company has also adopted the executive officer system to clearly separate the functions of management decision making and supervision from the functions of business execution. Senior managers of the main consolidated subsidiaries are appointed as executive officers of the Company with the objective of upgrading and improving the corporate governance system for the entire MEDIPAL Group. They periodically exchange information, as well as deliberate and conduct studies, which helps maintain organizational unity.

In addition, to promote efficient Group management activities, the representative director, directors, and representative directors of consolidated subsidiaries designated by the president hold the Group Presidents Meeting. Functioning as an advisory council, the Group Presidents Meeting convenes once a month, in principle, to share information on the Group's management strategies and deliberate and consider business solutions.

Composition of the Board of Directors at the End of March 2024

- 12 directors (including 4 outside directors)

- 10 male directors, 2 female directors

Meetings of the Board of Directors in FY2023

- Number of meetings: 13 times

- Attendance rate of outside directors: 92%

- Outside Audit & Supervisory Board members attendance rate: 97%

Director Appointment Policy

- Director Appointment Policy

The basic policy is to appoint as director individuals who will take the lead in sincerely implementing compliance initiatives as well as individuals with extensive experience, deep insight, and a high level of specialization in order to contribute to the MEDIPAL Group's sustainable growth and medium-to-long-term improvement of corporate value.

(1) Internal directors

Candidates are chosen from among individuals with work history and skills in corporate management, healthcare, M&As, governance, IT, etc. Candidates must possess the appropriate leadership skills to promote the MEDIPAL Group's management philosophy as well as a medium-to-long-term perspective as someone engaged in supervision of management's decision-making and business execution. We also give comprehensive consideration to factors such as personality and experience.

(2) Outside directors

Candidates are chosen from among individuals with extensive knowledge and experience of corporate management, healthcare, finance/accounting, legal affairs, international affairs, etc. We also give comprehensive consideration to factors such as personality and concurrent service as an officer at another company. In principle, the total term of office is a maximum of eight or twelve years (four years as an Audit & Supervisory Board member with two or three terms). Outside directors are prohibited from serving as an officer at more than four companies. Notwithstanding, even in the event that a candidate does not meet the separately determined independence requirements, an individual with deep insight and a high ethical viewpoint can be selected as a candidate for outside director.

However, in such a case, the ratio of independent outside directors shall be one-third or higher. - Director Appointment Procedure

Candidates shall be proposed to the General Meeting of Shareholders after deliberation by and reports from the Nomination and Compensation Committee (with the majority of members being outside directors and an outside director serving as the chair of the committee), and a resolution by the Board of Directors. The selection of representative directors as well as executive directors with special titles is conducted by the Board of Directors after deliberation by and reports from the Nomination and Compensation Committee. - Director Dismissal Procedure

In a case where a director commits an act that violates laws and ordinances or the articles of incorporation, or in a case where a director shows inadequate ability to carry out his/her professional duties due to negligence or other reasons, the Board of Directors will deliberate on the matter after fair and rigorous consideration by the Nomination and Compensation Committee.

Ensuring Diversity in the Board of Directors

The Company's Board of Directors is designed to have diverse representation as well as an appropriately balanced mix of knowledge, experience, and skills, including through the appointment of a number of outside directors and outside Audit & Supervisory Board members. The Company has appointed a diverse lineup of outside directors and outside Audit & Supervisory Board members, including former business executives and specialists in pharmaceutical development, accounting, and legal affairs, to ensure the effective functioning of the Board.

Use of Outside Directors

When appointing outside directors, the emphasis is on extensive experience, deep insight, and a high level of specialization, as well as the requirements stipulated in the Companies Act. We expect outside directors to contribute to improved corporate governance by contributing questions and opinions based on diverse perspectives that stimulate discussion at the Board of Directors meetings and contribute to appropriate decision-making. Our policy is for at least one third of directors to be independent outside directors. Of the 12 directors, four are outside directors, all of whom are independent outside directors. We believe we have appointed a sufficient number of independent outside directors based on comprehensive consideration of our industry, size, business characteristics, organizational structure, and the surrounding business environment. Of the five Audit & Supervisory Board members, three are outside members, all of whom are independent outside members. This system of monitoring and supervision of the Board of Directors by independent outside directors and independent outside Audit & Supervisory Board members ensures highly transparent management.

The Nomination and Compensation Committee

As a measure to enhance corporate governance, the Nomination and Compensation Committee was voluntarily established as an advisory body to the Board of Directors for the purpose of improving the fairness, transparency and objectivity of procedures related to the nomination and compensation of directors. The Nomination and Compensation Committee shall, in response to requests from the Board of Directors, deliberate and report to the Board of Directors on the following matters.

- Matters Related to Nomination

(1) Policy on appointment and dismissal of directors

(2) Matters concerning appointment and dismissal of directors (matters subject to resolution by the General Meeting of Shareholders)

(3) Matters concerning appointment and dismissal of representative directors

(4) Matters concerning appointment and dismissal of executive directors with special titles

(5) Matters concerning succession plans - Matters Related to Compensation

(1) Policy on compensation of directors, etc.

(2) Matters concerning director compensation limits (matters subject to resolution by the General Meeting of Shareholders)

(3) Matters concerning compensation of each director - Other Management Matters the Board of Directors Deems Important

The Nomination and Compensation Committee is composed of three members or more selected in accordance with the resolution of the Board of Directors. Outside directors account for a majority of the members, and the committee is also chaired by an outside director.

Activities by the Nomination and Compensation Committee FY2023 (a Total of Three Meetings Held)

- Regarding nominations, the Committee deliberated the following matters and reported its conclusions to the Board of Directors: (1) reappointment of the honorary chairperson and of advisors and (2) director candidates for the General Meeting of Shareholders in June 2024.

- Regarding compensation, the committee deliberated directors' bonuses to be paid in June 2024 and reported its conclusions to the Board of Directors.

- The committee will continue deliberations on (1) a review of director compensation (total amount of compensation, related evaluation items, eligible directors, introduction of a stock-based compensation system, etc.), and further increase opportunities for exchanges of opinion with outside directors on governance matters, including (2) the composition of the Board of Directors, and (3) succession plans.

Committee Composition (As of March 31, 2024)

| Nomination Committee | Compensation Committee |

|---|---|

| Toshio Asano (Committee Chair/Outside Director) | Toshio Asano (Committee Chair/Outside Director) |

| Mitsuko Kagami (Outside Director) | Mitsuko Kagami (Outside Director) |

| Kuniko Shoji (Outside Director) | Kuniko Shoji (Outside Director) |

| Hiroshi Iwamoto (Outside Director) | Hiroshi Iwamoto (Outside Director) |

| Shuichi Watanabe (Representative Director, President and CEO) | Toshihide Yoda (Senior Managing Director) |

| Yuji Sakon (Managing Director) | Yuji Sakon (Managing Director) |

Role and Composition of Audit & Supervisory Board

The Company employs a corporate audit system. In addition to attending an Audit & Supervisory Board, Audit & Supervisory Board members strictly audit the legality and adequacy of business execution by directors, based on the standards determined by the Audit & Supervisory Board, and exchange views with the independent auditors. The Audit & Supervisory Board members of the Group also exchange information and cooperate with each other.

Composition of the Audit & Supervisory Board in FY2023

- 5 Audit & Supervisory Board members (including 3 outside members)

- 4 male members, 1 female member

Meetings of the Audit & Supervisory Board in FY2023

- Number of meetings: 13 times

- Outside Audit & Supervisory Board members attendance rate: 100%

Attendance by Independent Officers

| Outside Directors' Attendance at Board of Directors Meetings in FY2023 | ||

|---|---|---|

| Mitsuko Kagami | 92% (12/13 times) | |

| Toshio Asano | 85% (11/13 times) | |

| Kuniko Shoji | 92% (12/13 times) | |

| Hiroshi Iwamoto | 100% (13/13 times) | |

| Outside Audit & Supervisory Board Members' Attendance at Audit & Supervisory Board Meetings in FY2023 | ||

|---|---|---|

| Tomoyasu Toyoda | 100% (13/13 times) | |

| Yoko Sanuki | 100% (13/13 times) | |

| Hatsuyoshi Ichino | 100% (10/10 times) | |

Support System for Outside Directors and Outside Audit & Supervisory Board Members

We have established a system that enables mutual cooperation between outside directors and outside Audit & Supervisory Board members and the Audit Office, Audit & Supervisory Board members, and independent auditors. This system enables these parties to coordinate as necessary, either directly or indirectly, through methods such as email or telephone. In addition, outside directors and outside Audit & Supervisory Board members share their views at meetings of the Board of Directors, and express their frank opinions on other occasions such as during briefings ahead of important discussions. The Company also periodically provides opportunities to view worksites at subsidiaries.

Evaluation of the Effectiveness of the Board of Directors

The Company periodically verifies the effectiveness of the Board of Directors. Based on those evaluations, we implement measures on an ongoing basis for the improvement of issues and the enhancement of our strengths. This analysis and evaluation of the effectiveness of the Board of Directors leads to functional improvements.

Analysis/evaluation process

The Board of Directors created a questionnaire for all directors and Audit & Supervisory Board members with the cooperation of a third party, and analyzed and evaluated the results. In addition, we confirmed the evaluation results and initiatives going forward based on a report from the third-party organization given at a Board of Directors meeting.

Analysis/Evaluation Outline of Results

The average score for the question asking for an overall evaluation of the effectiveness of the Board of Directors was 4.3, above the average score for all questions of 3.8.

The questions on whether discussions at the Board of Directors were open-minded returned a high average score of 4.5, and there were multiple comments confirming the liveliness of discussions in the free comment section. In terms of the operation of the Board of Directors, multiple answers showed that the respondents thought the prior briefings were functioning effectively.

In light of these results, we conclude that the Board of Directors is functioning effectively overall.

Issues Identified and Response Policies

The results from the questionnaires identified the following issues.

| Item | Issues for consideration |

|---|---|

| Composition of the Board of Directors | Reviewing appropriate numbers (ratio) of internal directors and (independent) outside directors |

| Operation of the Board of Directors | Securing enough time for discussions |

| Discussions at the Board of Directors' meetings | Following up with progress reports on business plans |

| Ensuring discussions are based on a sufficient awareness that business strategies and plans are consistent with sustainable growth of the company and the creation of corporate value | |

| Discussing how the overall Group business portfolio is designed and the need for review | |

| Reviewing how the business is managed with an awareness of capital costs and the share price | |

| Participating proactively in the formulation and implementation of succession plans for the CEO etc. | |

| Conducting sufficient discussions on the vision for and response to change through the use of data and digital technologies | |

| Board of Directors monitoring function | Monitoring investment decisions and investment status appropriately |

| Deciding the design of the management compensation system and actual compensation amounts | |

| Discussing potential risks for the Group as a whole, methods to address these risks, and crisis management systems | |

| Following up sufficiently on important matters resolved by the Board of Directors | |

| Ensuring sufficient discussion and appropriate actions regarding the perception of issues in the previous year's evaluation of effectiveness and methods to address these issues | |

| Engaging in sufficient discussion on the effectiveness of governance systems and the rationale for retaining the listed status of listed subsidiaries | |

| Appropriately supervising the development and implementation of Group governance systems | |

| Operation of the Nomination and Compensation Committee | Ensuring these voluntary Committees are effective |

Looking ahead, we will continue to consult on and select high-priority themes and will engage in specific, concrete discussions at the Board of Directors’ meetings.

Compensation for Directors

Our basic policy is to establish compensation levels and systems that are appropriate to the roles and responsibilities of each director as they work to realize our management philosophy, enhance corporate value, and achieve sustainable growth.

Compensation for directors includes base compensation and bonuses, and the amount of compensation is decided after taking into account general compensation levels in the market, our financial position, and the balance with employee salaries. The Nomination and Compensation Committee was voluntarily established as an advisory body to the Board of Directors for the purpose of improving the fairness, transparency and objectivity of procedures related to the nomination and compensation of directors and as a measure to enhance corporate governance.

- Policy on decisions relating to the amount of monetary compensation and the methods used to calculate this amount

Monetary compensation (i.e., compensation that is neither performance-linked compensation nor non-monetary compensation) is defined as a fixed monthly amount as base Compensation for Directors compensation paid in accordance with the position of each director. - Policy on decisions relating to the type of performance indicators used for performance-linked compensation and the methods used to calculate this amount or number

Performance-linked compensation is monetary compensation paid at a certain time every year as a bonus. The total amount is determined by the Board of Directors based on consideration of the consolidated performance in each fiscal year (consolidated operating profit) as an incentive for executive directors to be conscious of business performance. It is apportioned according to the standards for each position. - Policy on decisions relating to the type of non-monetary compensation and the methods used to calculate this amount or number

A system for non-monetary compensation has not yet been introduced, but for some time now we have been considering the introduction of a stock-based compensation scheme linked to the increase in corporate value as an incentive that functions with medium- to long-term earnings. The Nomination and Compensation Committee will also engage in various discussions on this matter. - Policy on decisions relating to the percentage breakdown for each type of compensation

Compensation for executive directors comprise fixed monthly base compensation and bonuses linked to short-term earnings.

The percentage breakdowns of these two types of compensation differ slightly depending on the position of each director, but in general the basic standard is for bonuses to account for approximately 25% of the total. The compensation for outside directors only consists of base compensation in view of their role and independence. - Methods to decide the content of compensation for individual directors

The amount of compensation for individual directors is left to the decision of the Representative Director and President, based on resolution by the Board of Directors. However, the Representative Director and President is advised by the Nomination and Compensation Committee and receives a report from the committee on draft compensation amounts for individuals.

The Nomination and Compensation Committee is composed of three members or more selected in accordance with a resolution of the Board of Directors. Outside directors account for a majority of the members, and the committee is also chaired by an outside director. In addition, persons nominated by the Audit & Supervisory Board members and committee chairperson can also attend as observers.

Total Amount of Compensation by Corporate Officer Category, Total Amount of Compensation by Category, and Number of Relevant Corporate Officers in FY2023

| Corporate Officer Category | Total Amount of Compensation (Millions of yen) | Total Amount of Compensation by Category (Millions of yen) | Number of Relevant Corporate Officers*2 | |||

|---|---|---|---|---|---|---|

| Fixed Compensation*1 | Performance-linked Compensation | Retirement Benefits | Non-Monetary Compensation, etc., Included in the Left Columns | |||

| Directors (excluding outside directors) | 255 | 189 | 66 | - | - | 9 |

| Audit & Supervisory Board members (excluding outside Audit & Supervisory Board members) | 46 | 46 | - | - | - | 3 |

| Outside directors | 57 | 57 | - | - | - | 4 |

| Outside Audit & Supervisory Board members | 32 | 32 | - | - | - | 4 |

*1 For fixed compensation, the number includes one director, one internal Audit & Supervisory Board member, and one outside Audit & Supervisory Board member who stepped down when they completed their term of office as of the close of the 114th General meeting of the Shareholders held on June 27, 2023.

*2 There are no officers receiving a total of compensation and other benefits of ¥100 million or more in FY2023.

Responsible Dialogue with Shareholders and Investors

General Meeting of Shareholders

In order to provide shareholders with sufficient time to make decisions on exercising their voting rights, the Company issued the notice of convocation for the June 25, 2024 Annual General Meeting of Shareholders on June 3, 2024, which is earlier than the legal requirement. Prior to this, the Company also made an early disclosure of its notice of convocation for the General Meeting of Shareholders on its website on May 27, 2024. In addition, since the General Meeting of Shareholders held in June 2002, the Company has enabled voting rights to be exercised electronically via the internet, in order to ensure that voting rights are exercised promptly and actively. Since 2006, the Company has also joined the voting rights platform for institutional investors operated by ICJ, Inc. to create an environment in which institutional investors may directly exercise voting rights by electronic means. In addition, other measures to invigorate the General Meeting of Shareholders and facilitate the exercise of voting rights, including posting the notice of convocation and details of the resolutions on our website, have been taken.

General Meeting of Shareholders on June 25, 2024

- Number of shareholders who exercised voting rights: 3,341

(of whom, the number of shareholders who exercised voting rights in writing or via the internet: 3,243) - Voting ratio: 84.9%

Dialogue with Institutional Investors

We maintain active dialogue with institutional investors through events such as financial results briefings for securities analysts and institutional investors, IR meetings with the President and the corporate officer in charge of IR, and various conferences hosted by securities companies. Feedback from investors is reported to management of the Company and the relevant departments as necessary, where it informs policy in areas such as MEDIPAL Group management strategy and governance.

IR Events for Institutional Investors in FY2023

- Briefings on financial results

Timing for the implementation: May and November 2023 (twice in the year)

Presenters: President, corporate officer in charge of IR

Event types: Online briefings - Dialogue with Overseas Institutional Investors (UK)

Timing for the implementation: November 2023

Presenters:Corporate officer in charge of IR, person in charge of IR

Event types: In-person meetings

IR Interviews with Institutional Investors in FY2023

- Number of IR interviews: 106 (Japan: 62; overseas: 44)

- Event types: Online and In-person meetings

Dialogue with Individual Investors

For dialogue with individual investors, we hold conferences in major cities throughout Japan every year with the aim of enhancing the Company recognition and establishing its brand. We also send newsletters to shareholders twice a year, in June and December, to deepen their understanding of our management philosophy and business strategy.

Conferences for Individual Investors in FY2023

We decided not to hold conferences for individual investors to help prevent the spread of COVID-19.

Basic Capital Policy

Our basic capital policy is to strive for sustainable growth as a company and maximize corporate value through business and financial activities focused on both "improving capital returns" and "reducing capital costs*."

In order to generate profits that exceed the cost of capital, we will regularly monitor and verify such costs, and pursue the optimal capital structure for our company while ensuring financial soundness. In order to achieve this, we are identifying areas for improvement and examining and scrutinizing specific indicators (KPIs), the level of achievement we should aim for, and the timing of achievement. Once this initiative is completed, we will promptly disclose the specific details.

*We recognizes WACC (weighted average cost of capital) calculated using the following formula as the cost of capital.

WACC (%) = Cost of equity* × Shareholders’ equity / (Interest-bearing debt + Shareholders’ equity) + Cost of debt x (1 - Effective tax rate) × Interest-bearing debt / (Interest-bearing debt + Shareholders’ equity)

* Calculated based on the capital asset pricing model (CAPM)

(Basic Policy on Strategic Shareholdings)

Our group's basic policy is to reduce the balance from the perspective of controlling stock ownership risk and improving capital efficiency. Regarding strategic investment stocks, we regularly verify the significance and economic rationality of holding them from the perspective of the social significance of the main business, the degree of contribution to profits by strengthening business relationships, etc., and if the appropriateness of holding is not recognized. We will work to gain the full understanding of our business partners before proceeding with the sale. In addition, even if the validity of holding the shares is recognized, the shares may be sold in accordance with the basic policy of reducing the balance and taking into consideration the market environment, management/financial strategy, etc. By the end of March 2027, which is the final year of the 2027 Medipal Medium-Term Vision, we aim to reduce the balance held to less than 10% of net assets and less than 50 billion yen.

Balance of strategic investment stocks for FY2023

13.7% of net assets

100.8 billion yen

We regularly verifies and confirms the significance and economic rationality of holding all strategic investment stocks. This verification and confirmation is based on the social significance of the main business and the degree of contribution to profits by strengthening business relationships, as well as the current and future profitability, taking into account the growth potential and capital cost of the business partner. This refers to comprehensively determining whether something contributes to maintaining and improving the corporate value of our group.

(Basic Policy on Distribution of Profits )

In addition to strategic investments that contribute to the stable growth of existing businesses, we are concentrating management resources on "new businesses," "medical devices and reagents business," and "AGRO・FOOD Business," which we have positioned as particularly important businesses. By doing so, we strive to continuously improve our corporate value.

Regarding profit distribution, in principle, we will "maintain and improve the dividend payout ratio stably based on the profit before deducting goodwill amortization and intangible asset amortization expenses arising from growth investments as set out in the 2027 Medipal Medium-Term Vision." While comprehensively assessing capital needs, our policy is to flexibly implement "acquisitions and cancellations of treasury stock" with the aim of improving capital efficiency and further returning profits to shareholders.

This will result in total shareholder returns for the five-year cumulative period from the fiscal year ended March 2023 to the fiscal year ending March 2027, based on the profit before deducting goodwill amortization expenses and intangible asset amortization expenses associated with growth investments listed in the 2027 Medipal Medium-Term Vision. We will strive to achieve a 40% propensity.

Profit distribution results for FY2023

Acquisition and cancellation of treasury stock:Both 4,171,900 shares (1.85% of thetotal number of issued shares before cancellation)

Dividend: Annual dividend of 60 yen per share (interim dividend of 30 yen, year-end dividend of 30 yen)

Profit distribution status for FY2024

Acquisition and cancellation of treasury stock:Both 2,065,300 shares (0.93% of the total number of issued shares before cancellation)

Dividend:Annual dividend per share: 60 yen (planned) (interim dividend: 30 yen, year-end dividend: 30 yen)

Special Circumstances affecting Large Impact on Corporate Governance

Among the Company's subsidiaries, PALTAC CORPORATION is listed on the Prime market of the Tokyo Stock Exchange. The Company’s views on the purpose of having listed subsidiaries and measures to ensure effective governance systems at listed subsidiaries are as follows.

- PALTAC engages in the Cosmetics, Daily Necessities and OTC Pharmaceutical Wholesale Business, and cooperates to generate synergy with the Prescription Pharmaceutical Wholesale Business, which is the main business of the MEDIPAL Group's other subsidiaries. The Group is striving to find a future growth strategy in the business fields of “Pharmaceuticals, Health, and Beauty” together with PALTAC.

Recently, the dispensing business of drugstores, our customers, has expanded. MEDIPAL is now able to offer total solutions to the needs of its customers. This also leads to enhanced synergy through coordination between PALTAC and MEDICEO CORPORATION.

PALTAC is highly significant in terms of the Group's efforts to achieve sustainable growth. The Group will utilize the know-how of both the Prescription Pharmaceutical Wholesale Business and the Cosmetics, Daily Necessities and OTC Pharmaceutical Wholesale Business to optimize the supply chain and enhance the Group's business fields as a wholesaler engaged in the distribution of products indispensable to people's daily lives. - The Company believes that from the standpoint of Group management, it is preferable for PALTAC to boost its corporate value by respecting its independence and actively conducting its business operations based on swift decision making. PALTAC decides on appropriate business strategies independently and in a self-directed manner.

- The Company plans to retain a majority of PALTAC’s shares and keep PALTAC as a consolidated subsidiary from the viewpoint of contributing to the improvement of corporate value for both companies. Furthermore, in our role as the parent, the Company dispatches directors to PALTAC to ensure appropriate Group governance.

However, PALTAC has established an independent committee of all the independent outside directors and independent outside Audit & Supervisory Board members, and is working to ensure protection of minority shareholders’ interests.