Risk Management

Basic Policy

1. Declaration

The MEDIPAL Group defines risks as "factors affecting the realization of the management philosophy," identifies and evaluates risks affecting corporate activities, and establishes a management system to prevent and reduce risks in an organized manner to promote risk management.

2. Purpose

In order to realize our management philosophy, we promote risk management as follows.

- (1) Maintenance and improvement of the corporate value

- (2) Conservation and effective utilization of management resources

- (3) Sustained and stable business continuity

- (4) To establish relationships of trust with stakeholders

- (5) To ensure the safety of executives, employees and other related personnel

3. Course of action

- (1) We consider risk management to be the most important issue for management and implement company-wide initiatives.

- (2) We strive to maintain and improve corporate value by implementing risk management.

- (3) We reflect social demands related to risk in the risk management structure.

- (4) Through continuous risk management, we strive to improve each individual's risk sensitivity, enhance knowledge, prevent and reduce risks, and improve our response capabilities.

- (5) In the event of a risk, we take prompt action to minimize the loss and work to recover as quickly as possible.

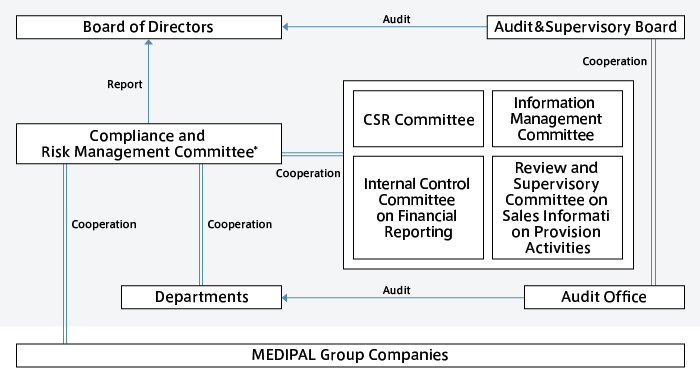

4. Promotion System

Based on the "Compliance and Risk Management Regulations" which stipulate the risk management structure and basic matters, we have established the “Compliance and Risk Management Committee” (chaired by the Chief Compliance Officer and the Representative Director, President and CEO) as an advisory body to the Board of Directors which grasps the overall risk information and takes prompt and appropriate measures to promote risk management throughout the entire Group.

Enacted: April 1, 2025

Shuichi Watanabe

Representative Director, President and CEO

MEDIPAL HOLDINGS CORPORATION

Risk Management Structure

* Chaired by the Chief Compliance Officer, the committee consists of executive directors with sales experience in the Prescription Pharmaceutical Wholesale Business and outside directors.

Business Risks

The main risks to the MEDIPAL Group's businesses are as follows. Statements regarding the future represent the positions of the Group as of March 31, 2022.

Various risks other than these exist, and the risks described here are not all of the risks faced by the Group.

1. Medical insurance system reform

The Prescription Pharmaceutical Wholesale Business, one of the MEDIPAL Group's core businesses, is intrinsically linked to Japan's social security system and medical policies. Japan is moving forward with healthcare reform in response to changes in the social environment such as growing social security costs due to demographic changes.

Going forward, the occurrence of any major institutional changes or events as unexpected that impact the business structure of the MEDIPAL Group may affect the performance and financial condition of the Group.

2. The NHI drug price system

Prescription pharmaceuticals, the main products handled by the MEDIPAL Group, are listed in the NHI (National Health Insurance) drug price standards, which stipulate the range of drugs that can be used in insured medical treatment and the billing prices of the drugs used. Therefore, the NHI drug price standards act as a ceiling on selling prices.

As part of government measures to control medical expenses, the prices set according to the NHI drug price standards are revised periodically based on surveys of prevailing market prices.

NHI drug price revisions, which had taken place in principle every two years, became yearly revisions from the fiscal year ended March 31, 2022. A drop in selling prices to medical institutions may affect the performance and financial condition of the Prescription Pharmaceutical Wholesale Business.

3. Risks related to specific legal regulations, etc.

The MEDIPAL Group handles various types of prescription pharmaceuticals and related products. Therefore, the Group conducts sales activities after receiving the necessary authorizations,

registrations, designations, and licenses from the local governments where business sites are located, or after notifying the government supervisory agencies, pursuant to the Law for Ensuring the Quality, Efficacy, and Safety of Drugs and Medical Devices, and other related laws. For this reason, the operating results of the Prescription Pharmaceutical Wholesale Business may be affected by the status of approvals and licenses issued by the relevant government supervisory agencies.

In addition, if companies from different industries were to enter the business domain of the MEDIPAL Group due to deregulation in the future, it may become difficult for the Group to maintain and expand its business and existing strengths. This may affect the performance and financial condition of the Group.

4. Trade practices with medical institutions

Prescription pharmaceuticals, the main products handled by the MEDIPAL Group, could affect people's lives, and impeding the distribution is unacceptable. As such, it is an industry-specific trading practice to deliver products to medical institutions while the price is still pending, and then carry out negotiations after delivery. To improve such trading practices, the Guidelines for the Improvement of Commercial Transaction Practices of Prescription Pharmaceuticals for Manufacturers, Wholesalers, and Medical Institutions/Pharmacies were enacted in April 2018. However, if negotiations prove difficult, the Group temporarily record net sales of these products with the sales price reasonably estimated by taking past results into consideration.

Therefore, a difference between the determined selling price and the estimated price may affect the performance and financial condition of the Prescription Pharmaceutical Wholesale Business.

5. Trade practices with pharmaceutical companies

The use of rebates and allowances results in substantive price reductions when trading with pharmaceutical companies that supply prescription pharmaceuticals, which are the MEDIPAL Group's main products. While we work to maintain favorable trading relationships with pharmaceutical companies, a drastic change in their sales strategies or trade practices may affect the performance and financial condition of the Prescription Pharmaceutical Wholesale Business.

6. Changes in the competitive environment

In the Cosmetics, Daily Necessities, and OTC Pharmaceutical Wholesale Business, one of the MEDIPAL Group's core businesses, competition is intensifying across industry types and business categories, and the size of the industry is continuing to expand due to M&As. For this reason, the Cosmetics, Daily Necessities, and OTC Pharmaceutical Wholesale Business is working to identify customer needs and build an organization capable of responding flexibly to environmental changes. However, an increase in competition, or a significant change in customers' policies or terms and conditions due to corporate reorganization may affect the performance and financial condition of the Group.

7. System interruptions

The MEDIPAL Group is actively promoting the use of IT in order to increase the efficiency and sophistication of its supply chains and to fulfill its role as social infrastructure that supports the reliable distribution of “Pharmaceuticals, Health, and Beauty.”

The business operations of the MEDIPAL Group are heavily reliant on computer network systems. In addition to duplicating the server network of core systems and taking measures such as seismic base isolation, disaster preparedness, and power outage countermeasures for the buildings where servers are housed, we have established a comprehensive data backup system. We have also implemented countermeasures for viruses and unauthorized access, and introduced data encryption for mobile PCs. However, in the event of system failure, sales and logistics functions may be significantly disrupted, and the Group's performance and financial condition may be affected.

8. Risk of information leaks

In the protection of information assets held by the MEDIPAL Group, including customer information and confidential information, the Group works to develop a management system that prevents information from leaking to any third party, and provides information security training twice annually to all employees based on its Information Security Policy. However, in the event that an information leak occurs due to unforeseen circumstances, it may affect the Group's performance and financial condition due to a decline in sales caused by a social reputation damage or an increase in costs related to countermeasures.

9. Disasters, traffic accidents and infectious diseases

The MEDIPAL Group handles the distribution of prescription pharmaceuticals, daily necessities, and other products indispensable to a healthy life. We are implementing a variety of measures to ensure that we reliably deliver the required products in normal times and during emergencies.

(1) Disaster risk

The MEDIPAL Group has established crisis management systems and a BCP (Business Continuity Plan) in preparation for natural disasters such as earthquakes and typhoons, an outbreak of new strains of influenza, or other such events, and to ensure the Group is able to carry out supply activities in the event of an emergency. However, if the Group's business operations are suspended due to a largescale natural disaster, the Group's business performance and financial condition may be affected due to decreased sales resulting from lost sales opportunities or incurring recovery costs or other expenses.

(2) Traffic accidents

The MEDIPAL Group uses many vehicles in its sales and delivery activities. In addition to using vehicles with low environmental impact, we are introducing vehicles equipped with dashcams and automatic braking systems to prevent traffic accidents.

In addition, we proactively conduct awareness-raising activities to promote traffic accident prevention, such as the establishment of a safe driving month and holding classes taught by police officers. However, in the event a serious traffic accident occurs, social reputation could be damaged, and this may affect the performance and financial condition of the Group.

(3) Infectious diseases

The MEDIPAL Group reliably supplies products which could affect people's lives. As such, we are ready for a wide range of emergencies related to pandemics affecting socio-economic activities and work to maintain a reliable supply system (establishing backup systems through the mutual cooperation of nationwide distribution centers, maintaining adequate product inventory, and accelerating planned maintenance of equipment). In addition, we strive to prevent the further spread of the virus (preventing the spread of infection among employees, thoroughly cleaning and disinfecting vehicles and equipment, and preventing the spread of infection at medical institutions).

Nonetheless, if logistics functions need to be suspended due to the COVID-19 epidemic among our employees, we will face difficulties in reliably supplying pharmaceuticals and other products, and this could affect the performance and financial condition of the Group.

10. Climate change

The MEDIPAL Group is working with a range of stakeholders to realize a decarbonized society. We are working to actively reduce greenhouse gas emissions by switching pharmaceutical transportation between some distribution centers from trucks to railroad containers and by collaborating with customers to develop a new, optimized model for pharmaceutical distribution.

However, the Group's performance and financial condition may be affected if we incur cost burdens in the future, such as carbon taxes or capital expenditures for disaster preparedness, or if we sustain significant storm and flood damage or our sales and distribution sites are affected by disasters or operational shutdowns.

11. Securing a labor force

In order for the MEDIPAL Group to reliably distribute the pharmaceuticals, daily necessities, and other products, it is essential to secure high-quality human resources and assign them appropriately.

In recent years, securing a labor force in the distribution field has become difficult due to the declining population resulting from the decreasing birthrate and aging population. In addition to boosting efficiency through labor-saving measures at distribution centers and revisions of delivery operations, we are implementing workstyle reform and taking steps to improve the work environment, but if the labor supply tightens further and adequate human resources cannot be secured, the Group's performance and financial condition may be affected. In addition, a significant increase in employee-related costs due to revised laws and systems or price fluctuations may affect the performance and financial condition of the Group.

12. Investing

The MEDIPAL Group is aggressively investing in the future to achieve sustainable growth.

(1) Investment in logistics infrastructure

The MEDIPAL Group is proactively investing in logistics and systems as well as introducing cutting-edge technology in order to carry out its social mission of safe, secure distribution. These activities are also essential for the Group to maintain its competitiveness. However, any increase in investment costs or the inability to earn the expected return on investments may affect the performance and financial condition of the Group.

(2) Investment in business development

With the aim of expanding its business foundation and diversify its source of earnings, the MEDIPAL Group invests in the development of new drugs by pharmaceutical companies and works in new drug development business on global. We aim to reliably supply medical treatments to patients with rare diseases by making eff ective use of the Group's management resources, such as its logistics capabilities and sales network. However, the development of new drugs takes time and may be suspended, and does not always proceed smoothly. As a result, we may incur losses and or not realize the earnings we expected, and this may aff ect the performance and fi nancial condition of the Group.

(3) Capital alliances and business partnerships

In line with the basic policy of our medium-term vision, namely, “Growing through business portfolio prioritizations and collaboration with partners,” we have been working under capital alliances and business partnership actively, moving beyond the boundaries of our industry into fields such as the digital realm and logistics, in addition to investing in startup companies, with a focus on venture companies in the life sciences field.

Regarding capital alliances and business partnerships such as these, prior to investment we consider profitability and return on investment from various perspectives. However, in the event of an unexpected environmental change or significant divergence from the assumed business plan, the Group may incur an impairment loss, which may affect the performance and financial condition of the Group.

13. Legal and regulatory infractions

The MEDIPAL Group has set “ensure thorough legal compliance” as one of its business policies, and continually carries out employee education and awareness activities.

In addition, we work to detect problems within the Group at an early stage, and have established whistleblowing hotlines both inside and outside the Company.

At a Board of Directors meeting held on January 29, 2021, a new Guiding Principle for Business Activities was adopted to clearly express the commitment of the CEO to compliance. The CEO has visited business sites throughout Japan to ensure that all employees embrace the spirit of the new policy and are familiar with the reasons for its adoption.

Additionally, a Compliance and Risk Management Committee* has been established as an advisory body to the Board of Directors. The committee will continuously monitor compliance in the Group and work to establish a spirit of observing regulatory compliance.

Nonetheless, if a legal violation occurs, not only will this necessitate the payment of monetary penalties through administrative measures, fines related to criminal proceedings, and damages through civil proceedings, the Group may face the negative impact of the loss of social reputation, and these may affect the performance and financial condition of the Group.

* On April 1, 2025, the Compliance Committee was renamed the Compliance and Risk Management Committee.