2027 MEDIPAL Medium-Term Vision

The 2027 MEDIPAL Medium-Term Vision, “Change the Oroshi Forever -Constant Innovation-” describes our strategy for realizing the MEDIPAL Group’s “ideal situation” by pursuing various possibilities in the business fields of “Pharmaceuticals, Health, and Beauty.”

Basic Policy of the Medium-Term Vision

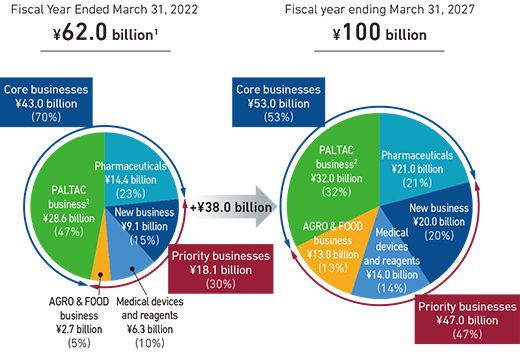

Overall growth image

We will carry out the following five growth strategies through business portfolio prioritizations and collaboration with partners.

① Expansion of overseas business

② Expansion of prevention and pre-disease business and AGRO

& FOOD business

③ Enhancement of business with and in digital

④ Building sustainable logistics

⑤ Value co-creation in community healthcare

Our human resource strategy and financial strategy are the foundation of our growth strategies. We will create social value and customer value through execution of our strategies to achieve the sustainable growth of the MEDIPAL Group.

Business portfolio prioritizations

To realize the Medium-Term Vision, we designated new businesses, the medical devices and reagents business, and the AGRO & FOOD business as priority businesses. By intensively investing management resources in these priority businesses, we aim to grow their share of ordinary profit to approximately 50% in the fiscal year ending March 31, 2027 from approximately 30% in the fiscal year ended March 31, 2023, and to achieve ordinary profit of ¥100 billion. Our core businesses consist of the Prescription Pharmaceutical Wholesale Business – the Group’s largest business that provides a stable supply of products that are indispensable to people’s daily lives – as well as the Cosmetics, Daily Necessities and OTC Pharmaceutical Wholesale Business. We will expand both of these core businesses, while also increasing added value and productivity further.

Aim for ordinary profit of ¥100 billion in the fiscal year ending March 31, 2027, with approx. 50% coming from priority businesses

- 1. Figure does not equal the sum of core businesses and priority businesses shown in the pie chart, mainly due to the inclusion of the elimination of transactions among business categories.

- 2. The ordinary profit figure for PALTAC business in the fiscal year ending March 31, 2027 is calculated based on PALTAC’s currently disclosed medium-term management plan, past performance, and other factors.

Management targets

Key Financial Indicators

| Item | Target | |

|---|---|---|

| Total Profitability | ROE | 9% in five years |

| Ordinary profit | ¥100 billion in five years | |

| Investment | Investment in growth | Approx. ¥100 billion over five years |

| Shareholder Returns | Total shareholder return ratio | 40% over a five-year cumulative period3 |

- 3. Details updated based on the basic capital policy resolved at a Board of Directors meeting on May 12, 2023.

Resolving ESG Issues through Growth Strategies

Set medium-to-long-term targets to steadily resolve ESG issues through growth strategies.

Initiatives for Decarbonization

Targets for Reduction of Greenhouse Gas Emissions*

FY2031: 50% reduction (compared with FY2021)

FY2051: Carbon neutrality* Total of Scope 1 + Scope 2

Promotion of Diversity and Inclusion

Women’s activity promotion target

FY2031: Proportion of women in managerial positions Over 20%

Sound and Transparent Corporate Management

• Expansion of training in compliance

• Construction of a corporate governance system to accommodate group companies